by Breanne Bouffard | Mar 12, 2025 | Estate Planning, Wills

In the domain of estate planning and inheritance law, one might come across the term “chattels” quite often, especially in instances where assets are distributed when someone dies without a valid will (intestacy) or when detailed instructions are stated by a willmaker...

by Claire Stollery | Feb 5, 2024 | Estate Planning, Wills

When a lawyer, accountant or financial planner asks you about your Will, they will typically ask about the distribution of assets (such as the family home, cash or cars) to beneficiaries (usually spouses, children and other friends or family). Where do pets fit into...

by Claire Stollery | Aug 2, 2023 | Estate Planning, Succession Planning, Wills

For many of our clients, protecting their assets for the benefit of their children is the utmost priority. Of particular concern is that their spouse or partner may remarry (or re-partner), either after separation or after our client’s death, and any of their assets...

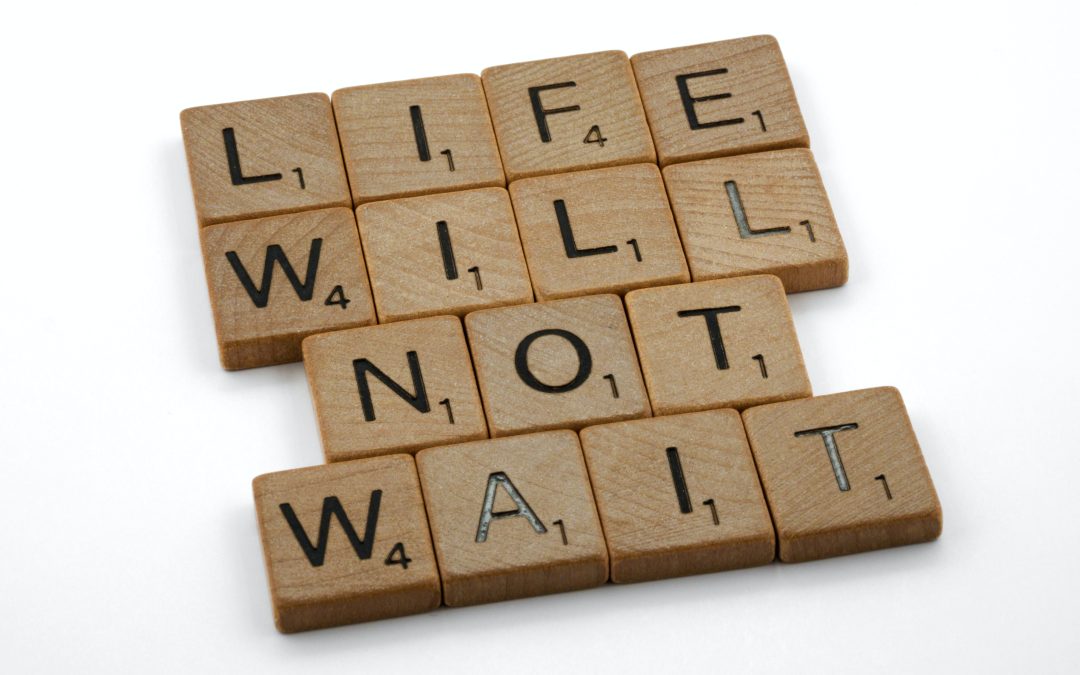

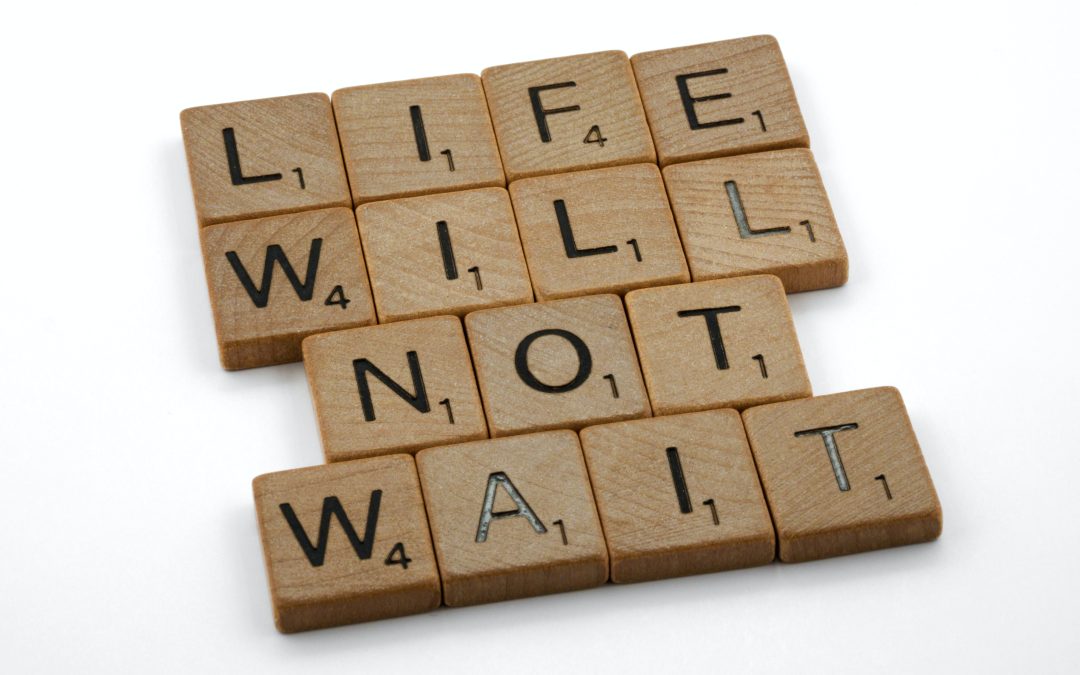

by Claire Stollery | Apr 5, 2023 | Estate Planning, Wills

In 2021, we published a blog post on the subject of ‘When it’s time to update your Will’, covering some of the most common scenarios that should prompt a review. In the two years since, we have seen even more situations arise between families that should have led the...

by Claire Stollery | Jan 23, 2023 | Estate Planning, Wills

When preparing a new Will, the guardianship of minor children is often at the forefront of our clients’ minds. For some clients, it can be difficult to choose who would be the most appropriate person to care for their children. This indecision can hold up the progress...

by Claire Stollery | Oct 11, 2022 | Estate Planning, Wills

Many clients with a real estate portfolio choose to create discretionary testamentary trusts (DTTs) in their Wills in order to pass the benefit of the portfolio on to their children. The DTT structure has many taxation benefits; however, it is also worth considering...